The Securities Commission Malaysia (SC) has announced the liberalisation of its regulatory framework to facilitate greater retail access to the RM1.3 trillion Malaysian bond and sukuk market.

Read more at https://www.thestar.com.my/business/business-news/2018/09/19/sc-liberalises-framework-for-retail-investment-in-bond-and-sukuk-market/#DDD0YdmyTdplKpvj.99

SGX invests in corporate bond trading platform Trumid

DBS Aims to Save 10,000 Manhours Through Whatsapp and WeChat Banking Service

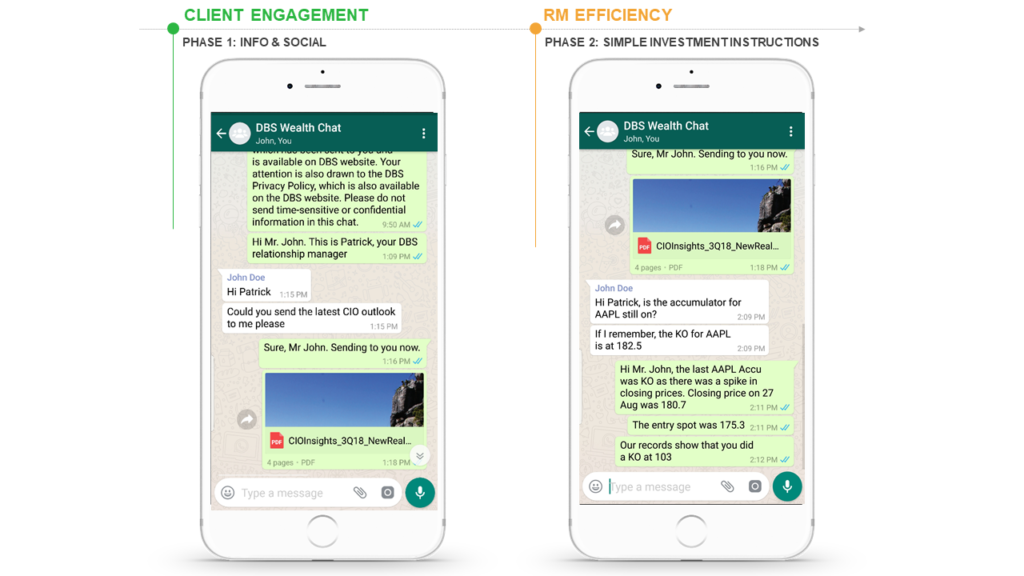

DBS announced the launch of DBS Wealth Chat, a service that will allow DBS’ wealth clients to interact, exchange ideas and transact with their relationship managers via popular instant messaging platforms WhatsApp and WeChat.

The bank claims to be the first in Southeast Asia to enable this service for its clients. Developed in partnership with regulatory technology (regtech) start-up FinChat, it enables DBS’ clients to use their existing instant messaging platforms to access DBS’ wealth services while meeting rigorous compliance standards.

The Process

To access the service, relationship managers can register interested clients in a private chat group with the bank. Upon confirmation, DBS will set up a unique chat group administered by the bank between the client and his/her relationship manager

Once the chat group between the relationship manager and client is initiated, conversations and file exchanges that occur within the chat group will be archived by the bank without any intervention required from the relationship manager. The entire process is fully automated.

Why is DBS Enabling Their Banking Services via Popular Messaging Apps

At present, relationship managers need to ensure key client conversations take place via the bank’s phone lines, where they can be recorded. DBS Wealth Chat allows RMs to communicate with clients on the go, on their clients’ preferred instant messaging platform. This, in turn, allows for speedier service delivery to clients.

The introduction of DBS Wealth Chat is estimated to save some 10,000 manhours on a yearly basis, while enhancing the ease and quality of relationship manager and client interaction.

“We recognise that customers today are inundated with different apps and services and decided to go where our customers already are – WhatsApp has upwards of 1.5 billion users, while WeChat has close to one billion users. Our aim is to provide banking services that are embedded in our customers’ everyday lives, while maintaining client privacy and keeping to our rigorous security requirements,”

said Tan Su Shan, Group Head of Consumer Banking & Wealth Management of DBS.

In the first phase, DBS will begin to register and onboard interested wealth clients in Singapore on the service, where content such as DBS Chief Investment Office reports, research insights and ideas, and exclusive invitations will be shared. Additional investment-related transactions (such as trade placement) will be introduced progressively in 2019.

MAS proposes legally-binding cyber security measures for all Singapore financial institutions

Electronic Bond Trading Set To Rise in Asia-Pac

Singapore debt market deepens with Asian Bond Grant Scheme

UBS trials Netflix-style algorithms for trading suggestions

Picking an investment may soon start to be more like choosing a TV show on Netflix or finding new music on Spotify.

UBS is looking at applying recommendation algorithms to suggest trades to its asset management and hedge fund clients, similar to those used by a host of consumer technology companies.

The move is in its early stages of development, with the task of reliably recommending interesting trades to investors posing very different challenges from suggesting a new indie band to listen to or what fresh comedy show to watch.

Nonetheless, the broad theory behind the initiative is the same, as finance increasingly borrows from the innovations of Silicon Valley’s technology companies. Increasing cost pressure on banks, coupled with the rise of computer-powered market players, has pushed banks to boost investment in their technology and explore new ways to automate some of their core businesses.

“Imagine what the world looked like when you watched television and had to scan through channels, whereas now it is not only on demand, it is presented to you so you easily find what you are looking for,” said Giuseppe Nuti, who heads up data science in UBS’s FX, rates and credit Strategic Development Lab. “That’s what we are trying to do for our clients, presenting them with a choice of likely, interesting trades.”

Just as people once took recommendations for TV shows or new music from friends or industry critics, a bank’s clients have often listened to recommendations from trained salespeople. UBS is hoping to make this process more automated, taking inputs of a client’s previous trading behaviour to assess whether they might be interested in a specific transaction. And it’s not just for clients.

The technology should help pinpoint investors that will want to buy something UBS is trying to sell, and vice versa. “A good sales person calls his or her client and goes over what they think will be interesting for the day,” said Mr Nuti. “We are trying to automate that.

It means the job of a sales person, which in many ways has remained immune to the technology revolution, will likely change.” The algorithm is currently being trialled in the bank’s corporate bond trading business but there are hopes to roll it out to other asset classes as well.

At the moment, recommendations produced by the technology are sent to salespeople to decide whether or not they should be passed on to clients, but over time the plan is to eliminate the middle man. The challenge is finding enough data to plug into the recommendation engine for it to produce reliable results, said Mr Nuti.

Each new TV show watched, or song listened to, is indicative of the type of music or television that a person likes. But it is harder to group trades into similar themes, says Mr Nuti, because people execute transactions for very specific reasons.

Other electronic trading experts have also urged caution. “While it sounds intelligent and advanced, a client should definitely ask a lot of questions about the construction of such a recommendation algorithm,” said Christian Hauff, co-founder of Quantitative Brokers, a trading algorithm company. “Creating and managing a financial instrument portfolio is not the same as creating and managing a playlist.”

U.S. SEC panel recommends review of electronic bond trading rules

Bond Trade Fees Are in Spotlight

Bond traders could receive a reprieve on the fees they pay under a new rule from the Securities and Exchange Commission requiring greater transparency.

The ruling revised rules on the fees brokers have to disclose on bond trades. The rule implemented by the SEC on May 14 requires brokers to disclose the fees they receive from corporate, municipal and agency bond transactions.

The rolling bandwagon of automated corporate bond trading: Algos oust traders

Bond trading is undergoing a quiet, but fundamental change: The automation of smaller-sized bond trades. Certainly, we are in the early days of this analogue-to-digital conversion, but the effects on the microstructure of bond markets are likely meaningful – especially with respect to the costs of execution. If you think smaller trades are not relevant in corporate bond trading: 90 percent of all trades are worth less than $ 1 million. In this blog post, I elaborate on how and why banks are starting to replace dealers with machines and describe why this is fertile ground for new electronic trading platforms. Finally, I propose a hypothesis on how trading costs may evolve in the future.